Don’t let inadequate construction site insurance turn your dream project into a financial nightmare – discover the essential coverage that could save your business millions.

Understanding the Critical Role of Construction Insurance

In the dynamic UK construction industry, where projects can range from modest residential builds to complex commercial developments, having comprehensive construction site insurance isn’t just a legal requirement—it’s a fundamental business necessity. Recent statistics show that construction-related insurance claims in Britain have risen by 35% since 2022, with the average claim value exceeding £50,000. This significant increase underscores the critical importance of proper insurance coverage in protecting your business against potentially devastating financial losses. From unexpected accidents and property damage to project delays and legal disputes, the risks inherent in construction work can quickly escalate into substantial financial burdens without adequate protection.

Core Insurance Types for Construction Projects

When developing a robust insurance strategy for your construction project, several essential types of coverage must be considered. Each type serves a specific purpose in protecting your business, employees, and assets throughout the construction process. Understanding these core insurance types is crucial for ensuring comprehensive protection against various risks and liabilities.

General Liability Insurance

General liability insurance forms the backbone of any construction insurance package in the UK. This coverage protects against third-party claims for bodily injury and property damage that may occur during construction activities. Recent industry data indicates that general liability claims account for approximately 40% of all construction-related insurance claims in Britain. This essential coverage typically includes:

- Protection against bodily injury claims from site visitors or passersby

- Coverage for damage to neighbouring properties

- Legal defence costs for covered claims

- Protection against advertising and personal injury claims

- Coverage for completed operations liability

Workers Compensation Insurance

In the UK, employers’ liability insurance (the British equivalent of workers’ compensation) is legally required for construction companies with employees. This crucial coverage protects both workers and employers in case of work-related injuries or illnesses. With construction accounting for nearly 25% of all workplace injuries in Britain, this insurance is particularly vital. The policy must provide minimum coverage of £5 million, though many companies opt for higher limits given the high-risk nature of construction work.

Builders Risk Insurance

- Covers materials and structures during construction

- Protects against fire, theft, vandalism, and weather damage

- Typically valid for the project duration

- Includes coverage for temporary structures and site security

- May extend to tools and equipment storage

Commercial Auto Insurance

Commercial vehicle insurance is essential for any construction business operating vehicles in the UK. This coverage protects company vehicles used for transporting materials, equipment, and workers to and from construction sites. Statistics show that construction vehicles are involved in 15% more accidents than standard commercial vehicles, making comprehensive coverage crucial.

Specialized Construction Insurance Solutions

Wrap-Up Insurance Programs

Wrap-up insurance programmes, including Owner Controlled Insurance Programs (OCIP) and Contractor Controlled Insurance Programs (CCIP), are becoming increasingly popular in the UK construction sector. These comprehensive packages can provide significant cost savings and streamlined coverage for large projects. Projects utilizing wrap-up insurance report an average of 15% reduction in insurance-related costs compared to traditional individual policies.

Professional Liability Insurance

- Protects against claims of professional negligence

- Covers design errors and omissions

- Essential for design-build contractors

- Includes coverage for project management mistakes

- Can extend to subcontractor errors

Legal Requirements and Compliance

Construction insurance requirements in the UK are governed by various regulations and contractual obligations. The Construction (Design and Management) Regulations 2015 mandate specific insurance requirements, while individual contracts may stipulate additional coverage needs. Failure to maintain proper insurance can result in fines of up to £2,500 per day and potential project shutdowns.

Risk Assessment and Policy Selection

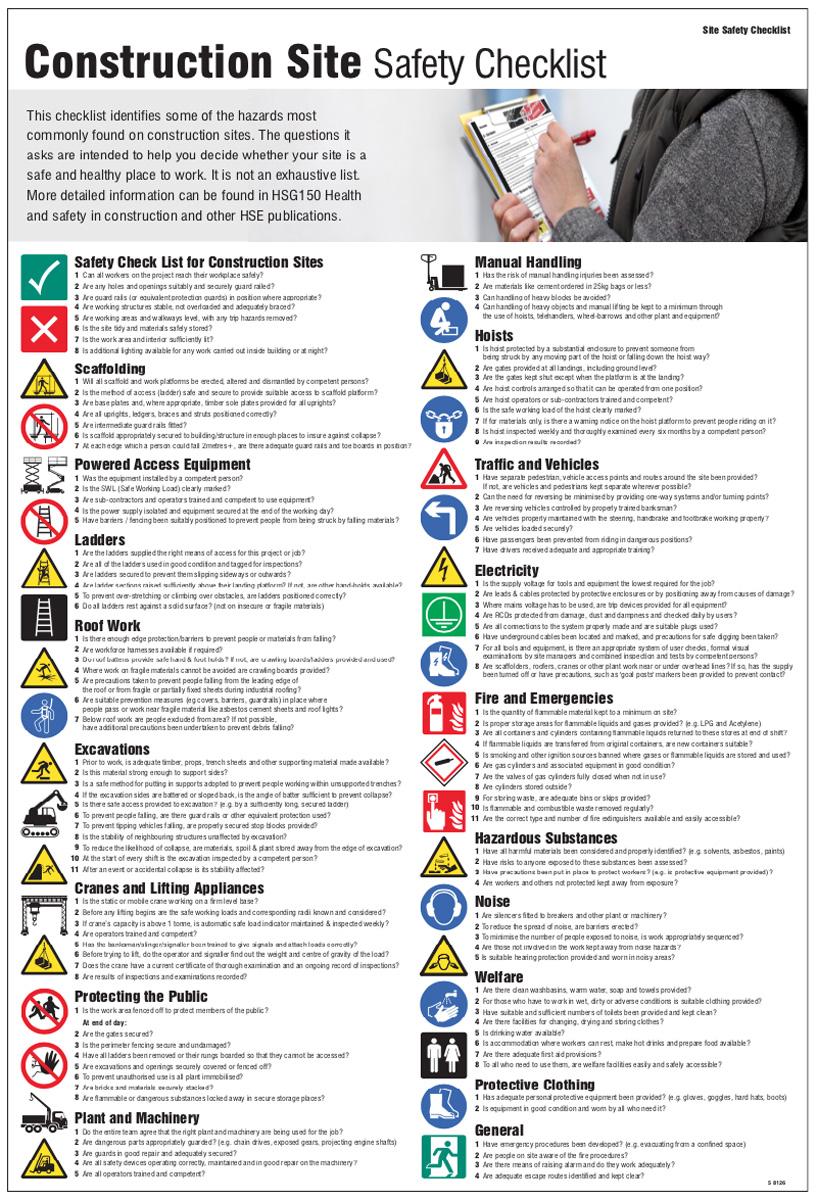

Evaluating Project Risks

Conducting thorough risk assessments is crucial for determining appropriate coverage levels. Factors to consider include:

- Project size and complexity

- Location and environmental factors

- Subcontractor involvement

- Timeline and potential delays

- Valuable materials and equipment

Cost-Benefit Analysis

When selecting insurance coverage, it’s essential to balance premium costs against potential risks and benefits. Industry data shows that properly insured projects are 60% less likely to face significant financial losses due to accidents or delays. Consider factors such as deductible levels, coverage limits, and exclusions when comparing policies.

Making Insurance Work for Your Construction Business

Effective insurance management requires ongoing attention and regular policy reviews. Key strategies include maintaining detailed documentation, implementing strong safety programmes, and establishing clear communication channels with insurers. Construction companies that actively manage their insurance programmes report 40% fewer claims and more favorable premium rates over time.

Conclusion: Protecting Your Construction Investment

Comprehensive construction site insurance is not just a regulatory requirement—it’s a crucial investment in your business’s future. With construction costs and risks continuing to rise in the UK market, proper insurance coverage provides essential protection against financial losses and ensures project continuity. Take time to thoroughly assess your insurance needs, consult with experienced brokers, and regularly review your coverage to ensure your construction business remains well-protected in today’s challenging environment.

FAQ

Why is construction insurance so expensive?

The major determining factor for calculating builders’ risk insurance is the total value of a project, which includes the cost of materials, labor, and any existing structures that may be part of the construction. Typically, the higher a project’s value, the higher the associated insurance premium.

How do contractors get insurance?

You may be required, either by law or the company that hired you, to have this coverage. Most contractors need several business insurance policies to protect against these different risks, but you can usually buy them together from the same insurance company.

Is builders risk insurance worth it?

Builders risk insurance has a broader coverage scope than a homeowners policy. Builders risk for remodels or new home construction is the best coverage option. It offers complete coverage for construction under one policy. This is better than adding coverages to a homeowners policy.

Who pays for construction insurance?

Usually, the cost of builder’s risk insurance may be included in the total cost of construction. Otherwise, a general contractor may suggest purchasing a policy, but finding a company and paying for the insurance could likely fall on a homeowner.

Can you get construction insurance per job?

Get construction insurance that works on your schedule. Whether you need insurance by the job, month, or year, you’re covered with Thimble. Our business insurance for contractors can come with Business Equipment Protect, whether using your own equipment or a client’s.

Sources

[1] https://buildern.com/resources/blog/construction-insurance/

[2] https://www.insureon.com/blog/types-of-construction-insurance

[3] https://www.higginbotham.com/blog/wrap-up-insurance/

Leave a Reply